Connecting mindset and financial performance: Can the stock market performance of a company be predicted based solely on the mindset of its leadership

Can stock market performance be predicted based only on how people think?

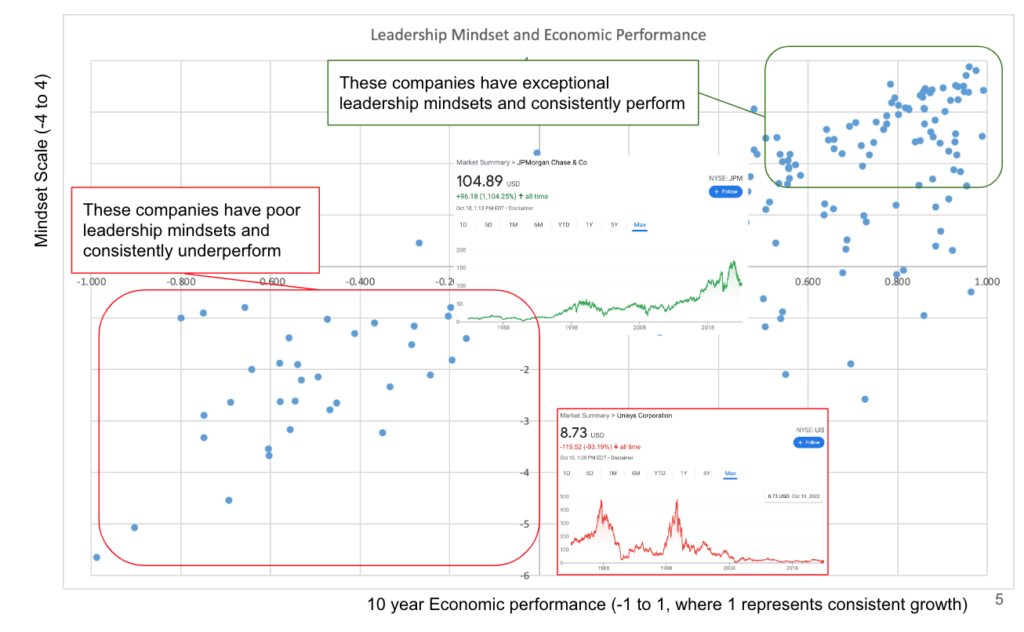

In recent years I’ve begun the task of connecting the mindset of leadership to financial performance and ultimately stock market performance. I don’t know if there are other means to getting better results but I do have a way of picking companies that are more likely to be long-term successful than not. In back testing, a 4.5 to 5.3:1 is possible with much optimization.

For example, AutoZone does not disappoint due to their hiring practices over the last 10 years. They continue to hire better leader ship consistently.

After calculating hundreds of thousands of people, namely leaders across a multitude of industries, it can be said that hiring the likes of hashtag#FredFlintstone and hashtag#ArchieBunker to run your company will not work – at all. While these are fictitious characters they’re not far off from some people in corporate America today. I use these names as easy to identify examples. High levels of opportunistic thinking, obstructionist thinking as well as over discipline rule makers do not create great companies. Sorry. Very little evidence of that working out.

Companies that continue to hire consistently better people year-over-year will often hire at capacity level 6 to 18 months ahead of financial needs. Think of it this way. You put a lightbulb in a broom closet. You don’t need a lot of wattage. When you come back the next day and the broom closet is mysteriously four times larger you need a lot more wattage. The same can be said for companies. If you know the room is expanding, you need to plan ahead and get those bright lightbulbs in place before somebody trips.

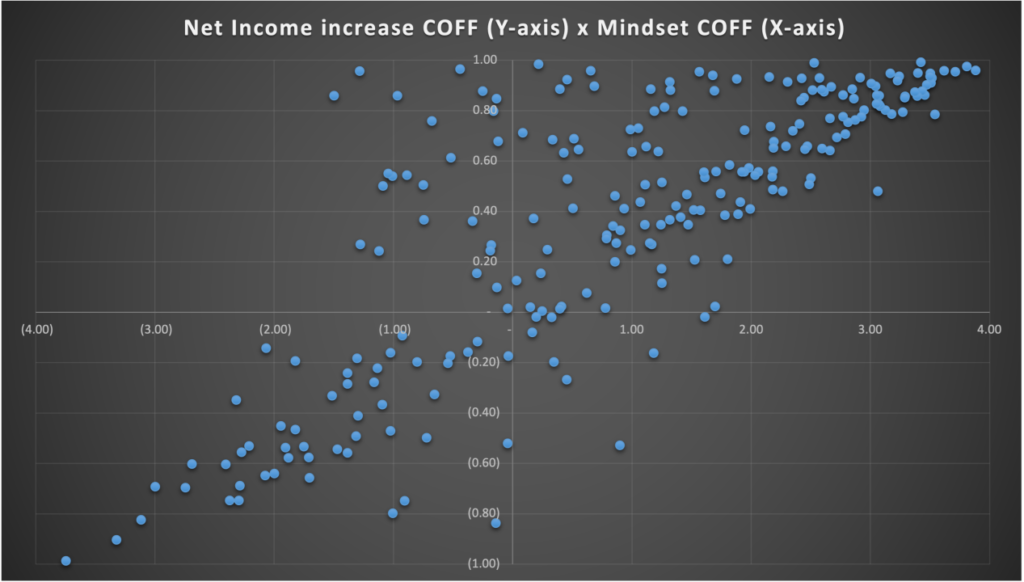

This is a roughed in Y over X chart which attempts to explain mindset versus performance. The X axis represents Mindset growth over time. The more you go to the right the more likely that company is hiring higher mindset capacity year over a year. The reverse is true if you go to the left side. You can see a -1 versus +1. Simply put, there’s a high degree of correlation between hiring consistently year over a year on the X axis.

Y axis is the relationship of net revenue growth year over year. The more steady and the higher levels of consistent increases in net revenue represent the top of the Y axis. Likewise, companies that struggle, porpoise or are in decline or at the bottom of the Y axis.

Th data represented is only a sample of the total. What you may see is great companies to the upper right are hiring greater mindset capacity before financial needs year over year. Their reward (in the public market) is high stock market performance. While nobody is immune to things like inflation and supply chain, these companies are less likely to be encumbered by external events.

When you look at the entire ecosystem of people, which includes vendors, employees, leaders and even customers, the more you hire ahead of financial needs, the more likely you are to succeed in the long run. What kinds of mindsets and when you hire them and then what mixtures is a Stealth Dog Labs secret sauce.

It’s common sense that people with higher mindset capacity or more likely to lead and create their futures. No matter the industry, there’s sufficient proof to indicate this is a better way of building business vs ‘flying blind’.